The HDFC Bank Tata Neu Infinity Credit Card is a semi-premium, co‑branded credit card designed to maximise rewards through NeuCoins, a cashback‑equivalent rewards currency that works seamlessly across the Tata ecosystem.

HDFC Bank issues two variants: Tata Neu Plus & Tata Neu Infinity

The Infinity variant is clearly the better one, thanks to better rewards and lounge access. Opting for the RuPay version unlocks UPI transactions with rewards, which is arguably the core value proposition of this card.

Overview

Fees

Joining Nil (FYF/LTF)

Reward Type

Rewards (Neucoin)

Return

1.5% to 5%

Rating

Table Of Content

Fees

| Joining Fee | Rs 1499 +GST ~Rs |

| Welcome Benefit | 1,499 NeuCoins (on paid cards) |

| Annual Fee | Rs 1499 +GST ~Rs |

| Annual Fee Waiver | On spending >3 Lakhs |

| Renewal Benefit | none |

| Type | Semi Premium Credit Card |

While it’s easy to grab First Year Free (FYF) offer on HDFC Bank’s Tata Neu Infinity Credit Card, getting Lifetime Free (LTF) offer is becoming harder in 2025, compared to how it used to be in the past.

Rewards

| Type of Spend | REWARD RATE | MAX CAP |

| Regular Spends | 1.5% | ~ 2.4% |

| UPI Spends (via TataNeu App) | 1.5% | 500 NeuCoins (per month, combined) |

| UPI Spends (on other Apps) | 0.5% | 500 NeuCoins (per month, combined) |

| Spends on TataNeu App (Bill Pay & Tata brands) | 5% | as per category |

Limitation on Rewards:

- Insurance, Groceries, utility, Telecom & Cable all capped at 2,000 NeuCoins / month for each category as above.

- Education payments made through third-party apps like CRED, MobiKwik, etc will not earn NeuCoins.

- Some merchants may not offer additional 5% rewards via NeuPass.

- 5% rewards applicable for transactions done only via Primary Card Holder Mobile Number Account (as per credit card application) on Tata Neu

- Currently, Bill Payment (Tata Pay), Tanishq, Cult.fit, Air India, Tata Play spends are not eligible for additional 5% NeuCoins via NeuPass Membership

The limits are ideally good enough for a regular user and 5% rewards on these categories are rare to see in the segment.

NeuPass

With NeuPass Membership, you get:

- Additional 5% NeuCoins on eligible Tata Neu spends

This stacks with the card’s 5% rewards (on select categories), giving you up to 10% effective return.

On top of that, you also get good discounts by booking on the app with brands like BigBasket & Taj Hotels.

Fair Usage Policy: Caps on Tata Brand Merchants’ Rewards

| Category | Max Monthly Spends Eligible for 5% NeuCoins | Max Annual Spends Eligible for 5% NeuCoins |

| Croma | Rs 6 Lakh | Rs 18 Lakh |

| Tata CLiQ, Westside | Rs 3 Lakh | Rs 18 Lakh |

| IHCL, Air India Express, Air India | Rs 8 Lakh | Rs 30 Lakh |

| 1MG, Cult, Tata Play | Rs 2 Lakh | Rs 15 Lakh |

| Bill Payments – Tata Pay | Rs 1 Lakh | Rs 6 Lakh |

| Big Basket | Rs 1 Lakh | Rs 12 Lakh |

| Titan, Tanishq | Rs 6 Lakh | Rs 18 Lakh |

| Food Delivery via Tata Neu | Rs 50,000 | Rs 6 Lakh |

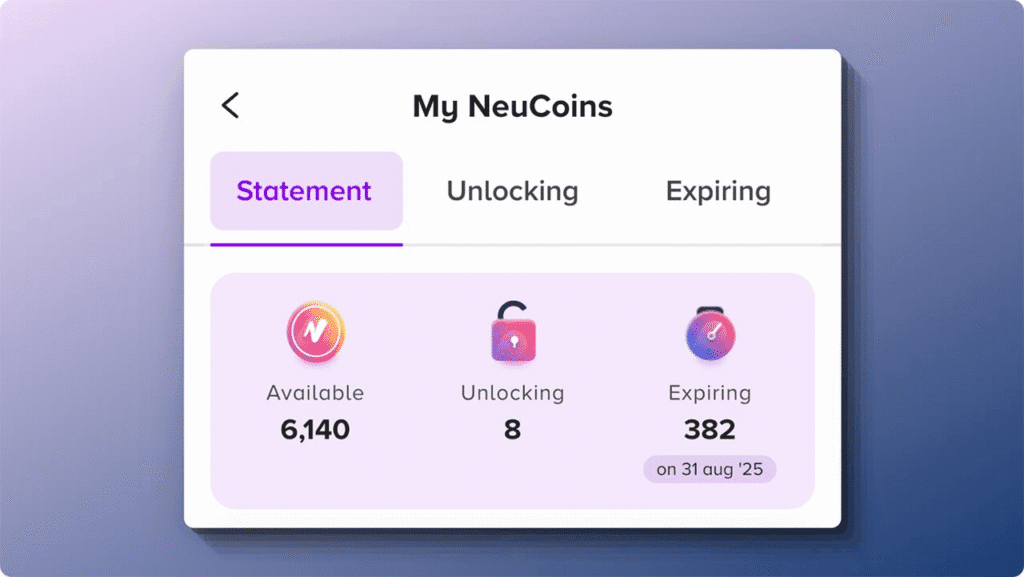

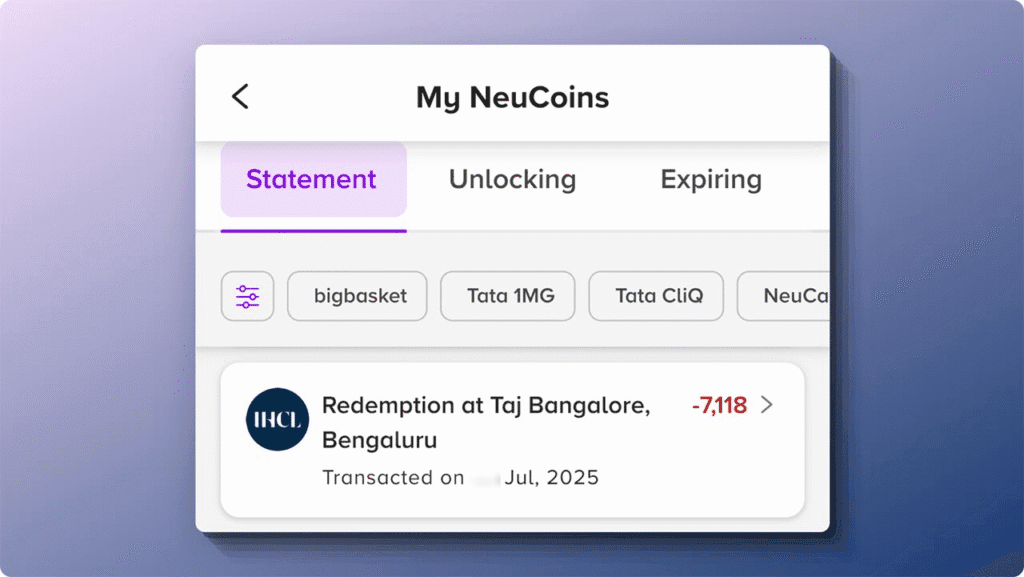

Rewards Redemption

1 NeuCoin = 1 INR

NeuCoins are cash-equivalent and easy to redeem across Tata partner brands. While there are many options, redeeming for Tanishq gold coins is the popular choice.

If you’re into travel, you can also redeem NeuCoins at Taj Hotels which is perfect for settling any remaining balance after applying Taj vouchers.

Other Key Benefits and Charges

- Fuel Surcharge Waiver: 1% waiver for transactions between Rs 400 and Rs 5000. Maximum waiver of Rs 500 per statement.

- Interest Rates: 41.88% Annually

- Cash Withdrawal Fees: 2.5%

- Rent Transaction fees: 1% per transaction (Max 3000)

Foreign Currency Markup fee

- Foreign Currency Markup Fee: 2%+GST = 2.4%

Complimentary Airport Lounge Access

| Access Type | ACCESS VIA | ACCESS LIMIT |

| Domestic | Visa / Rupay | 2/Qtr |

| International | Rupay/ Priority Pass | 1/Qtr (shared) |

Effective 10 June 2025, domestic lounge access is now milestone-based. To qualify, you must spend ₹50,000 or more in a calendar quarter.

For domestic access, lounge vouchers will be issued. Receive SMS/email to claim voucher within 120 days, then lounge usage valid within 180 days. Link to details.

For international access, on Visa, Priority Pass is issued on request.

Pros and Cons

Pros

- Excellent rewards program.

- Low foreign markup fee.

- Annual fee waiver on spends of ₹3 lakhs in a year.

Cons

- No reward points on Fuel Spends, Wallet loads and Smart EMI.

- Reward points are only valid for one year.

- Neu Coins for Grocery Spends is capped at 2,000 Neu Coins per month.

Final Thoughts

The HDFC Tata Neu Infinity Credit Card is one of the most rewarding UPI credit cards in the country, particularly beneficial for those who are in the Tata ecosystem. In this segment, you might as well be interested in the SBI Cashback Credit card (no UPI advantage though) that offers 5% direct cashback on most online spends.

HDFC Tata New Infinity Credit Card