The Scapia Credit Card is a co-branded card issued by Federal Bank in partnership with Scapia, who markets and distributes the card.

Scapia Credit Card is designed for the new-age travellers who prefer to have travel experiences as rewards over the usual cashback type rewards.

The Scapia app is modern, easy to use, and offers one of the smoothest application processes in the country.

Overview

Fees

Nil (LTF)

Reward Type

Rewards (Scapia coins)

Return

upto 4%

Rating

Table Of Content

Fees

| Joining Fee | Nil [Lifetime Free] |

| Welcome Benefit | None |

| Annual Fee | Nil [Lifetime Free] |

| Renewal Benefit | none |

| Type | Travel Credit Card |

In summary, the Scapia Federal Bank credit card is an LTF offering with zero forex markup. This is a pretty good reason to get it unless you have some other credit card that offers your zero forex markup.

Rewards

| Type of Spend | REWARD RATE | MAX CAP |

| Regular Spends | 10% | 2% |

| Travel Spends (on Scapia App) | 20% | 4% |

We earn Scapia coins for spends on the card. The card features advertise the reward rates as 10% and 20% Scapia coins. But, this translates to a return between 2% to 4% as 5 Scapia coins are equal to Rs 1. Scapia’s app doubles up as a travel booking app. Any flight or hotel bookings on the app get a 4% reward rate.

Excluded category for rewards:

Rent, Education, Gift Cards, Fuel, Government Spends & Wallet Top-Ups

Limitation on Rewards:

- Utility, telecom, and cable bill payments (MCCs: 4900, 4812, 4814, 4816, 4899) earn 10% rewards or coins on spends up to ₹20,000 per billing cycle

- Utility (or) Fuel spends over 50,000 INR will attract 1% fee (upto 3K INR)

- Utility spends over ₹50,000 per billing cycle will attract a 1% convenience fee plus GST, capped at ₹3000 per transaction

- Rent & Wallet Load will attract 1% fee (max. upto 3K INR)

Rewards Redemption

5 Scapia Coin = 1 INR

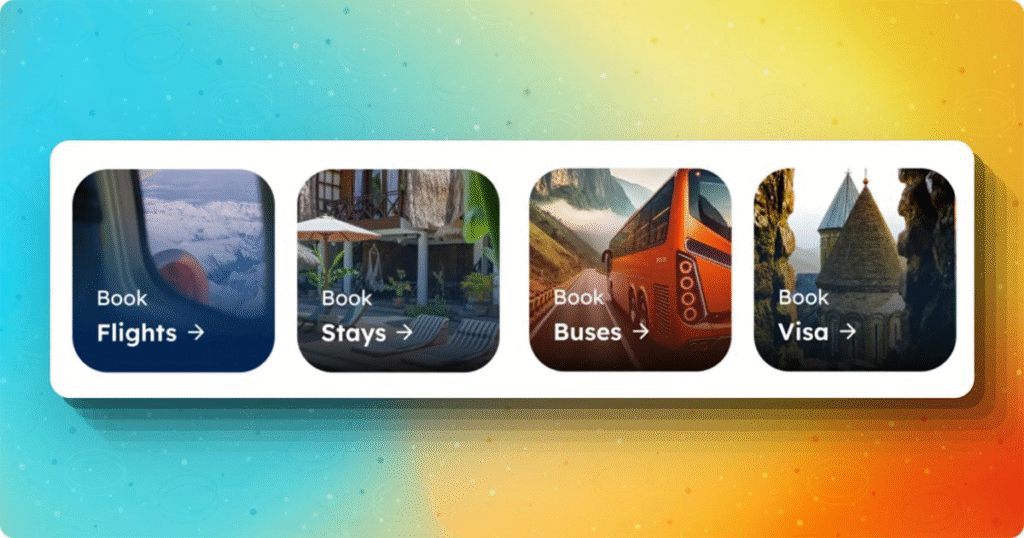

Scapia coins can be used not just for flights and hotels, but also for buses, trains and even Visa, a unique feature. However, Visa redemptions are bit pricey from what I see.

The good news is you can redeem 100% of your Scapia coins for travel.

Other Key Benefits and Charges

- Fuel Surcharge Waiver: 1% waiver for transactions on fuel spends up to ₹5000 per billing cycle (Maximum waiver: ₹500)

- Interest Rates: 45% Annually

- Cash Withdrawal Fees: 2.5%

- Rent Transaction fees: 1% per transaction (Max 3000)

Foreign Currency Markup fee

- Forex Markup Fee: 0%

- Reward rate on Intl. Spends: 0%

- Net gain: 0%

0% forex markup is usually seen only on select premium cards, but the Scapia Credit Card brings it to everyone, helping especially beginners save a lot on international spends.

Complimentary Airport Lounge Access

| Access Type | ACCESS VIA | ACCESS LIMIT |

| Domestic | Visa / Rupay | 2/Qtr |

Spend Requirement: 10,000 INR per month on Visa (or 15K INR on Rupay)

It’s indeed a surprise to see unlimited lounge access on the card with spend requirement as low as 10,000 INR, which is fair enough.

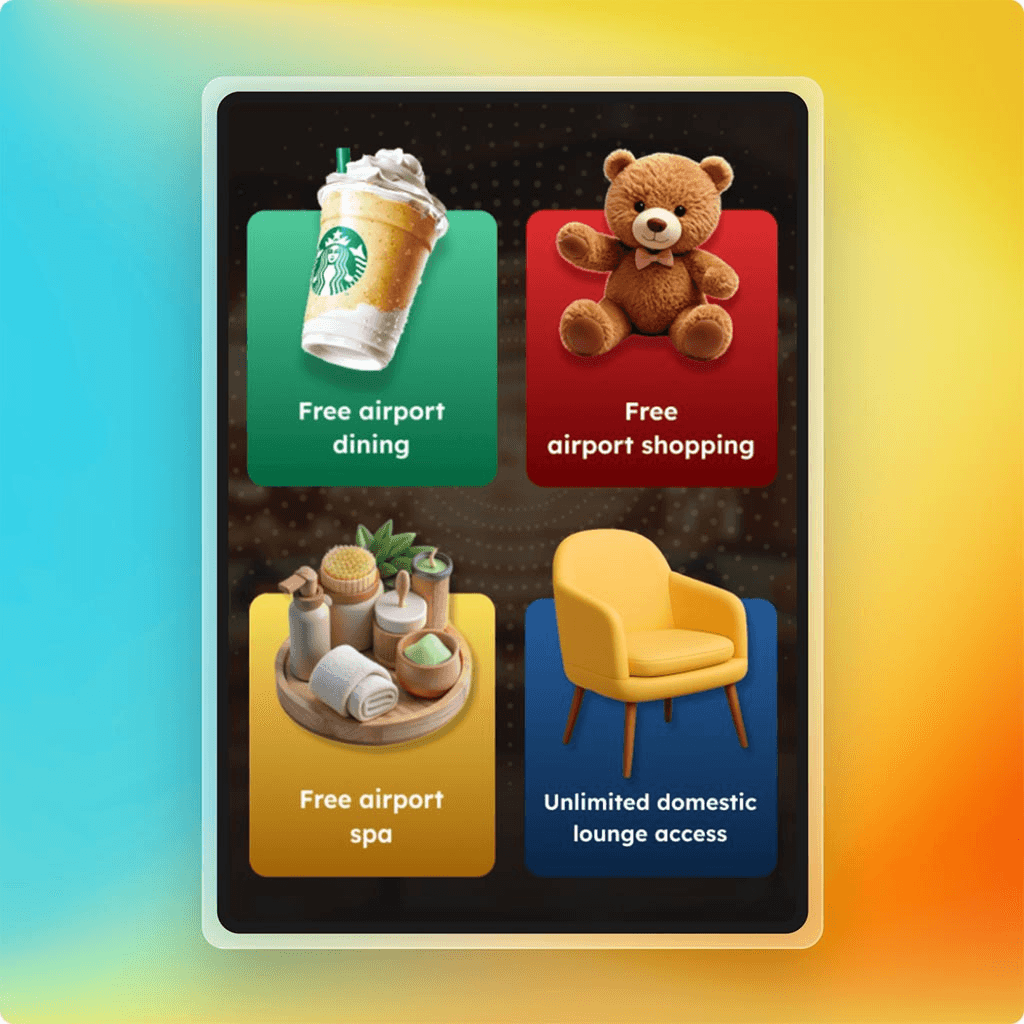

Speaking of lounge access, it’s one of the four options you can choose under the airport privileges benefit on this card. Let’s look at them in detail:

Airport Privileges

This is another unique benefit from Scapia that we have not seen on other cards. You can earn upto ₹1000 back in Scapia coins on spends at airport outlets. Be it food, shopping or spa it is valid for all.

Limit: 1 access (either one of above) for every departure.

This is a unique benefit that most other cards don’t offer, and it’s a brilliant idea. Assuming you get lounge access on other cards, you can use this benefit to shop something at the airport.

Here’s how it works:

- Meet the spend requirement. (10K INR on Visa; 15K INR on Rupay)

- Open the app, select the option: Shop, Dine, Lounge, Spa

- Activate the outlet where you want to spend.

- Spend using the card.

You’ll get Scapia coins worth up to ₹1,000 at metro airports (Mumbai, Delhi, Bangalore, Chennai, Kolkata, Hyderabad) and ₹500 at other airports.

The benefit applies to every “Departure” (not arrival) and there is no limit on how many times you can avail this, so it’s an outstanding benefit if you fly often.

The app is well designed to understand the whole process, so you won’t go clueless.

Essentially, every time you visit the airport, you have an option to go for some free shopping if lounge is not your thing.

Pros and Cons

Pros

- Lifetime free card (no joining or annual fee)

- Zero forex markup on international transactions

- Unlimited domestic airport lounge access.

- Up to 4% rewards on Scapia app travel bookings

Cons

- Not eligible if you already have a Federal Bank credit card or loan

- Rewards only usable for travel via Scapia app.

- No rewards on fuel, rent, wallet loads, and excluded utility spends.

Final Thoughts

The Scapia Federal Bank Credit Card is a solid lifetime-free travel card with a smooth digital onboarding process, 2% base rewards, zero forex markup, and unlimited domestic lounge access. The app integration makes usage seamless. However, its 4% reward rate on travel spends feels underwhelming compared to other portals offering higher discounts, and the Federal Bank one-card limit may restrict many users. Overall, it’s a good choice for frequent travelers, but has room for improvement with a premium variant and better travel rewards.

Federal Scapia Credit Card

Is there any joining or annual fee for the Scapia Federal Bank Credit Card?

No, the card is lifetime free with zero joining and annual fees.

How can I redeem my Scapia coins?

Scapia coins can only be redeemed for flight and hotel bookings on the Scapia app.

Can I earn rewards on all spends?

No, rewards are not offered on fuel, rent, EMI, education fees, gift cards, crypto, and wallet loads.