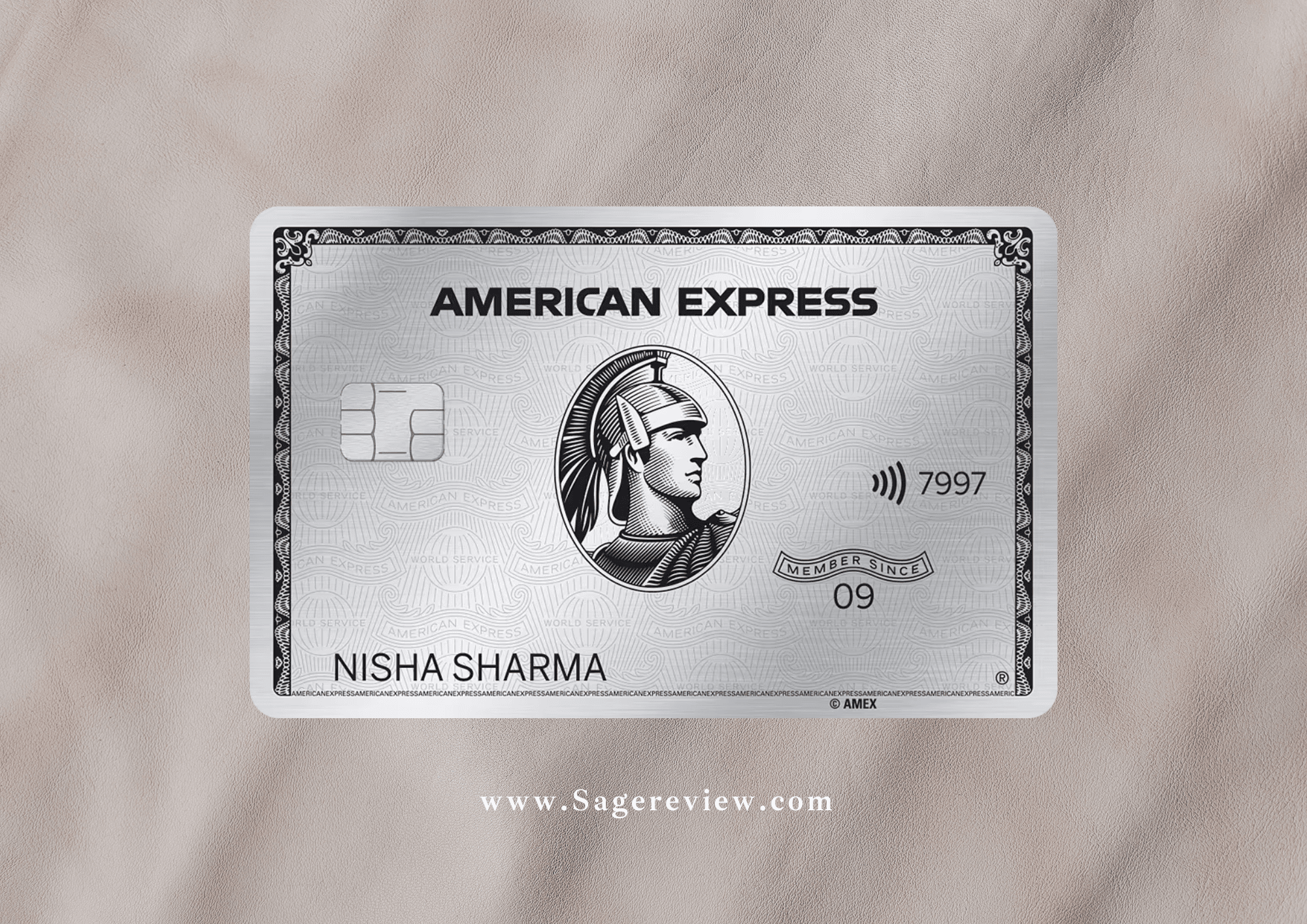

American Express is synonymous with global luxury, and if you are looking to experience the absolute pinnacle of their card ecosystem, the American Express Platinum Card is the definitive answer.

Issued as a hefty, precision-crafted metal card in India, the Platinum Card is an ultra-premium “Charge Card.” Unlike a traditional credit card, it typically features no pre-set credit limit, offering the ultimate financial flexibility for high-net-worth individuals who value status and service over all else.

Here is why this prestigious metal card remains the ultimate status symbol:

Overview

Fees

Joining: ₹66,000 + GST = ₹77,880

Reward Type

Points

Return

1.25% – 2.5%

Rating

Table Of Content

Fees

| Joining Fee | ₹66,000 + GST = ₹77,880 |

| Welcome Benefit | 100K MR points (or) Rs.60,000 Taj/Luxe vouchers |

| Annual Fee | ₹66,000 + GST = ₹77,880 |

| Renewal Fee Waiver | Spend 3.5 Lakhs (excludes: rent & wallet spends) |

| Renewal Benefit | Upto 35,000 INR vouchers |

| Type | Ultra premium Credit Card |

| Best For | Hotel benefits & Concierge service |

American Express Platinum Charge Card is one of the very few cards in India that’s valued based on the lifestyle benefits (like Marriott Gold Status) it offers and not just by looking at the reward rate.

With 100K points one can get a value >50K INR by transferring them to Marriott Bonvoy, among other options. While only Taj vouchers are available as regular welcome benefit, there is a way to still get 100K MR points, more on that shortly.

Note that, every once in a while American Express also sends Upgrade offer for the platinum card with lucrative welcome bonus for select existing Amex Card holders, upto 150K MR points like the one we recently got in Jan 2025.

The “Secret” Welcome Bonus Hack

Publicly, the card is often marketed with a Taj Stay Voucher (typically worth ₹60,000). However, if hotel vouchers aren’t your style, here is a pro-tip:

- The Switch: You can often request 100,000 Membership Rewards (MR) points instead of the Taj vouchers.

- The Timing: You must call Amex support to request this before you activate the physical card. While not guaranteed, these requests are frequently approved.

Rewards

| Type of Spend | REWARDS | REWARD RATE |

| Retail Spends | 1 MR point/Rs 40 | ~1.25% to 2.5% |

| International Spends | 3 MR points/Rs 40 | ~3.75% to 7.5% |

| Fuel Spends | 5 MR points/Rs 100 | ~2.5% to 5% |

| Insurance, Utilities, EMI | NIL | NIL |

- Gold Charge, the second charge card from Amex is the only one that gets MR points on insurance and utilities. Even the top end Plat Charge card misses out on this.

- Fuel spends up to Rs 1.25 Lakh per month get 5 MR points/Rs 100. Post that, the revised reward rate is 1 MR point/Rs 100.

The reward rate above is based on the minimum value you can usually get from Marriott Bonvoy point redemptions. If you explore new properties or stay at hotels in less touristy locations, the value can go up to around ₹1 per point.

Earn 5X* Membership Reward points on every purchase through Reward Multiplier*

Get up to 20X* Rewards on 20+ luxury brands with Rewards Xcelerator

Rewards Redemption

There are many ways to redeem Amex MR points, but I’ve personally found the best value when using them for Marriott stays.

I have got a value >1 INR / point at times, but most of the time I’ve got ~1 INR / point. However, it’s hard to fix a static value since the dynamic award pricing keeps changing.

That said, many Platinum cardholders transfer their points to Marriott Bonvoy for maximum value. From there, you can even transfer MB points to airlines and sometimes get an even better deal. American Airlines and Aeroplan are popular options.

| Partner | Conversion Rate | Minimum Redemption Points |

| Asia Miles | 2 MR = 1 Asia Miles | 800 MR |

| Emirates Skywards | 2 MR = 1 Skywards mile | 800 MR |

| Etihad Guest | 2 MR = 1 EG mile | 1,600 MR |

| Hilton Honors | 1 MR = 0.90 Hilton Honors Points | 1,000 MR |

| Marriott Bonvoy | 1 MR = 1 Marriott Bonvoy Points | 100 MR |

| Qatar Privilege Club | 2 MR = 1 Avios | 500 MR |

| Singapore KrisFlyer | 2 MR = 1 KrisFlyer Mile | 800 MR |

| Virgin Atlantic Flying Club | 2 MR = 1 Virgin Point | 800 MR |

| Finnair (Finnair Plus) | 2 MR = 1 FP Point | 800 MR |

If you prefer direct airline transfers from Amex, Singapore Airlines, Cathay Pacific, Virgin Galactic & Avios (Qatar & BA) are quite good. For ex, you can fly direct from Bangalore to London in business class for as low as 30,000 Virgin Points (60K Amex MR points) + 20K tax if you’re flexible with dates.

Kaizen Offer

Yatra E-Gift voucher worth INR 15,000 upon making spend of INR 1 Lakh or more in a single booking with American Express Platinum Travel and Lifestyle Services.

The offer can be availed fourtimesin a Calendar year.

Complimentary Hotel Memberships

The Plat Charge is all about complimenting your lifestyle. If you are a traveller, then it adds more value to your trips.

| Hotel Loyalty Program | Tier | Value |

| Marriott Bonvoy | Gold | ~₹ 20,000 |

| Hilton Honors | Gold | ~₹ 20,000 |

| Radisson Rewards | Premium | ~ |

| Taj Epicure | ~ | ~ |

| All Accor+ | Traveler | ~ |

| The Postcard Hotel Sunshine Club | Platinum | ~ |

| Hertz | Gold Plus | ~ |

Marriott Bonvoy (Gold):

This is one of the biggest benefits of the Platinum Card. The combo of Gold Elite status plus the 100K welcome bonus points makes the card very rewarding.

If you stay around 10 nights a year and get at least 5 successful upgrades, you can easily extract ₹20,000+ value from the Marriott Gold tier. Many cardholders even manage to get ₹50,000 or more in value from this benefit alone. This usually gets me upgrades, breakfast, 2PM late checkout.

Hilton Honours (Gold):

Hilton hotels are not that popular in India but we do get more options in countries like USA. We get room upgrades subject to availability and an 80% bonus earn rate on Hilton Honors points. Gold status also gets you complimentary breakfast outside the USA. The complimentary breakfast benefit is especially valuable in Europe, where breakfast for two can easily cost around €50.

With just 5 nights a year, you could save over ₹20,000 on breakfast alone.

Taj Epicure:

This benefit is especially useful if you regularly use Spa or Salon services at Taj hotels, since you get 20% off on the bill.

The upgraded Taj Epicure membership now includes 1 complimentary birthday cake and 2 Taj Club Lounge visits, which together are worth well over ₹5,000.

Radisson Rewards:

Radisson Rewards program does not get much visibility in India due to limited transfer partners. But if you are opting for a revenue stay, then get the status benefits like up to 20% room discounts, Room Upgrades early check-in and late check-out etc.

Golf Benefits

- Complimentary Games: 4 per month

- Complimentary Lessons: 2 per month

Enjoy complimentary games and lessons across 30+ domestic Golf Courses in India and 50+ golf courses worldwide. Limiting lessons to 2 per month along with many other restrictions is actually not so good for a card that costs this high.

Forex

- Forex Markup Fee: 3.5%+GST = 4.13%

- Reward rate on Intl. Spends: 3.75% – 7.5% (3X rewards)

- Net gain: ~3.3% (only if you can get 1 INR per 1 MR)

It’s a decent credit card for international transactions as you gain over 3% of the spend. However, this is only for those who can extract a value of 1 MR = 1 INR as mentioned in above examples.

It’s not for everyone! I personally prefer to use other cards for international transactions unless the merchant is new & of low profile.

That said, thanks to Amex’s zero lost card liability, it often makes more sense to use your Amex card over others when you’re traveling abroad, simply for the peace of mind it offers.

Platinum Concierge

The Amex Platinum concierge has lost some of its former luster, with a clear decline in service quality over the last few years. One major pain point is the removal of email support; having to call for every request is a step backward in convenience compared to the previous digital-friendly setup.

The service is divided into two primary pillars: Travel and Lifestyle.

✈️ Travel Concierge

This team handles the logistics of your trips. Their scope typically includes:

- Visa Assistance: Navigating documentation and requirements.

- Bookings: Managing flights and hotel reservations.

- Itinerary Planning: Building custom schedules for your travels.

The “VIP” Hack: I’ve used the travel desk for years to book Taj hotels, consistently securing ~20% off standard rates. Because these bookings are flagged as “VIP” from the Amex Centurion travel desk, they almost always trigger a complimentary room upgrade.

🎩 Lifestyle Concierge

Marketed as a “Do-Anything” service, this team is designed for high-end requests, though its value often depends on having a lifestyle that requires complex coordination.

- Task Delegation: You don’t need a gala to plan to use them; they are great for delegating small, time-consuming errands.

- Personal Track Record: Having submitted over 100 requests in the last four years, I’ve found they are helpful but tend to under-perform during peak travel seasons when the system is strained.

Other Key Benefits and Charges

- Fuel Surcharge Waiver: Fuel surcharge is waived at all HPCL fuel stations for purchases up to Rs. 5,000, 1% surcharge applicable on BPCL and IOCL stations and 2.5% surcharge applicable at all other fuel stations.

- Interest Rates: 42% Annually

- Cash Withdrawal Fees: 3.5%

- Forex Transaction Fees: 3.5% +GST

Complimentary Airport Lounge Access

| Lounge Type | Access Limit |

| Domestic Lounges | Unlimited (Primary and Supplementary Cards) |

| The Centurion® Lounge | Unlimited Access for Primary Card + 2 guests |

| Priority Pass™ Lounges | Unlimited (Primary + 1 Supplementary Card) |

| Delta Sky Club® Lounges when flying Delta | Unlimited Access for Primary Card |

| Escape Lounges | Unlimited Access for Primary Card + 2 guests |

Note: You may need to request for a Priority Pass after getting the card. However, Digital priority pass will be available instantly, if required.

Pros and Cons

Pros

- The card offers exclusive discounts on Hotel and Travel Benefits.

- It comes with free access to premium airport lounges globally.

- The card gives VIP access and assistance to exclusive events worldwide.

Cons

- Annual fee is quite high which is not affordable by many.

- Insurance does not cover items like gold, silver, antiques, securities etc.

- There isn’t any waiver of the annual fees with this card.

Final Thoughts

The Amex Platinum is designed for those who view travel and dining not just as activities, but as experiences. While the high entry cost is a barrier for some, the card delivers a suite of benefits that can easily outweigh the fee for a frequent globetrotter. Family Value: You can issue up to 4 complimentary supplementary cards. Your family or friends can enjoy almost all the primary benefits (like lounge access and hotel status) alongside you. Elite Status, Fast-Tracked: Skip the “nights stayed” requirements and jump straight into higher tiers of loyalty programs like Marriott Bonvoy, Hilton Honors, and Radisson Rewards. The Global Lounge Collection: Beyond the standard Priority Pass, you get exclusive access to the high-end Amex Centurion Lounges, Delta Sky Clubs, and Escape Lounges. So if you love Amex and want to experience this metal at-least once, then nothing gonna stop you from getting it. Enjoy the Platinum Life!

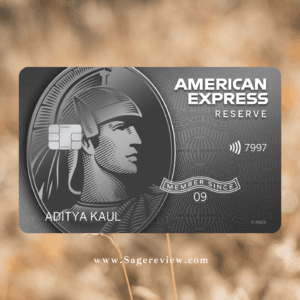

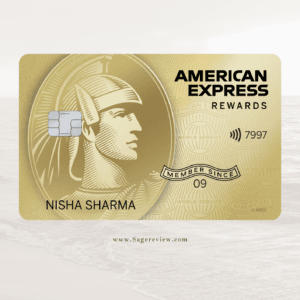

Alternatives: Axis Reserve, IDFC Select, HDFC Infinia, ICICI Emralde Private

American Express Platinum Charge Credit Card

What are American Express Charge cards?

Charge cards are American Express’ category of super premium credit cards. American Express offers only two charge cards: the Platinum and Gold Charge Card. These cards have no preset credit limit and offer many premium benefits.

What is the validity of American Express Membership Rewards Points?

The Membership Rewards Points do not expire.

Apply through the above link & you’ll be rewarded additional 10,000 Referral Bonus Membership Rewards® points.