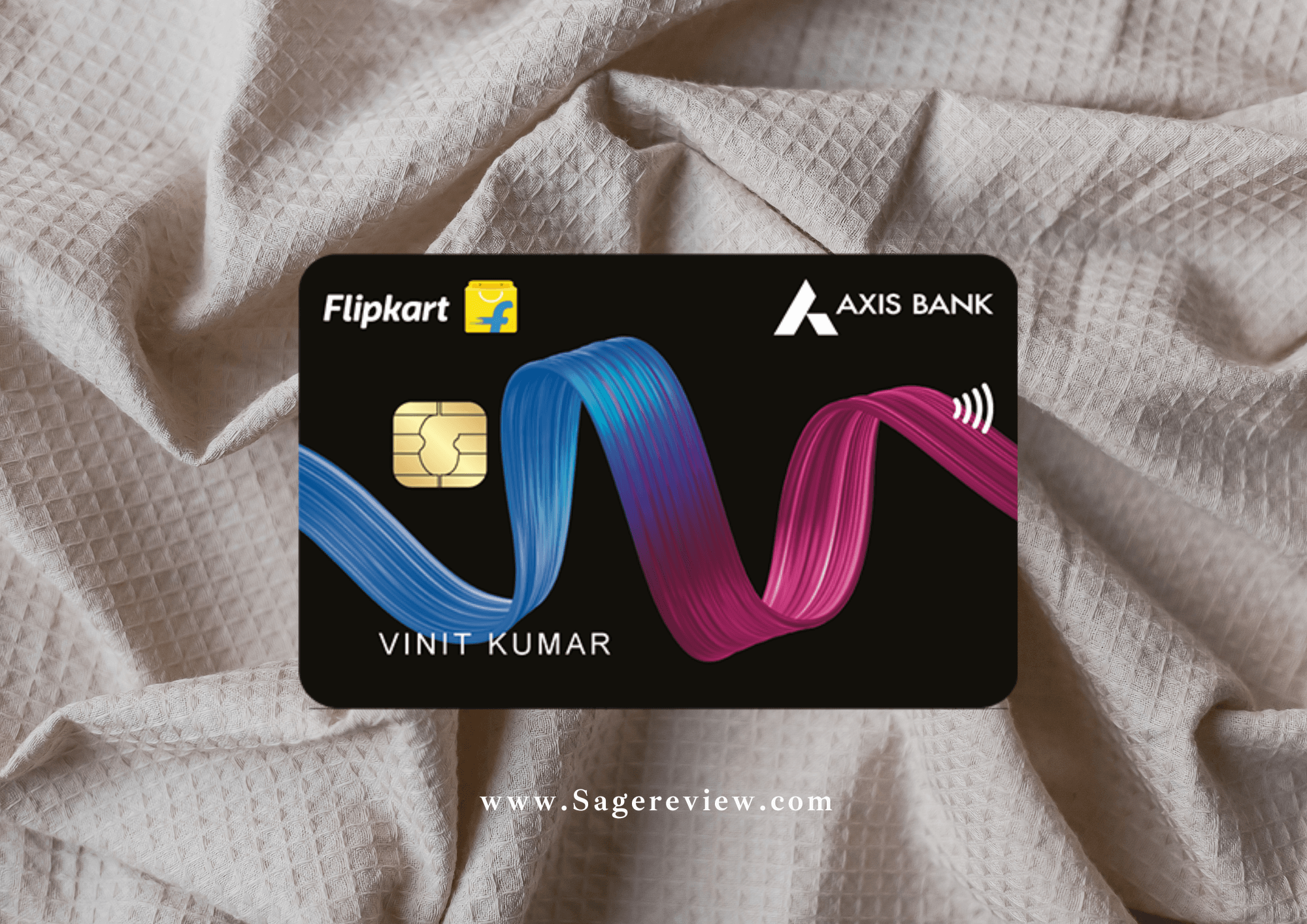

It’s been about six years since the Axis Bank Flipkart Credit Card was launched. While it was quite rewarding at the time of launch, it has undergone several rounds of devaluation over the past couple of years.

Overview

Fees

Joining: NIL

Reward Type

CashBack

Return

upto 7.5%

Rating

Table Of Content

Fees

| Joining Fee | Nil [Offer: First Year Free] |

| Welcome Benefit | 250 INR Flipkart Voucher (on paid cards) |

| Annual Fee | ₹500+GST ~₹590 |

| Renewal Fee Waiver | Spend 3.5 Lakhs (excludes: rent & wallet spends) |

| Renewal Benefit | none |

| Type | Co-brand Credit Card |

Axis Flipkart Credit Card is an entry-level / co-brand / cashback credit card that offers auto-credit of eligible cashback to the statement, just like any other cashback credit cards.

Rewards

| Type of Spend | REWARD RATE | MAX CAP | Spend to Reach Cap |

| Myntra | 7.5% | ₹4000 Per Quarter | ₹53000 Per Quarter |

| Flipkart | 5% | ₹4000 Per Quarter | ₹80000 Per Quarter |

| Cleartrip | 5% | ₹4000 Per Quarter | ₹80000 Per Quarter |

| Preferred Brands | 4% | Unlimited | NIL |

| Other Spends | 1% | Unlimited | NIL |

Excluded category for rewards:

Rent, Education, Gift Cards, Fuel, Government Spends & Wallet Top-UpsUtility, Telecom, Fuel, Clock, Jewelry, Watch and Silverware Stores, Insurance, Financial Institutions, Rent, Wallet, Education & Government Services.

Preferred Merchants: Cult, PVR, Swiggy, Uber

Rewards Redemption

5 Scapia Coin = 1 INR

Other Key Benefits and Charges

- Fuel Surcharge Waiver: 1% Fuel Surcharge Waiver across all petrol pumps in India. Upto 400 INR per statement. (Txn size: Rs. 400 – Rs. 4,000)

- Interest Rates: 52.86% Annually

- Cash Withdrawal Fees: 2.5%

- Rent Transaction fees: 1% per transaction (Max 3000)

- Forex Transaction Fees: 3.5% +GST

- Swiggy offer: 50% instant discount on Swiggy with Code: AXISFKNEW, upto 100 INR for new users only.

Complimentary Airport Lounge Access

- Domestic Airport Lounge Access: Not Available

- International Airport Lounge Access: Not Available

Pros and Cons

Pros

- 5% cashback for Flipkart and Cleratrip purchases

- 7.5% cashback for Myntra purchases

- Minimum 1% cashback for transactions

Cons

- Cashback on other spends has reduced from 1.5 to 1%

- No cashback for wallet, fuel and a lot of other categories.

- No Complimentary Lounge Access.

Final Thoughts

The Flipkart Axis Bank Credit Card was once a strong product with lounge access and broad perks, but multiple devaluations have narrowed its appeal. Today, it mainly shines for loyal Flipkart and Myntra shoppers. The card is reasonably priced, though it isn’t Lifetime Free. The downside is a long list of exclusions, such as government and utility payments, along with quarterly cashback caps that restrict its overall versatility.

Compared to the Amazon Pay ICICI Card, Flipkart Axis offers the advantage of direct cashback instead of locked-in rewards but falls short in fee structure and broader coverage. Ideally, Flipkart could reposition this card as a Lifetime Free mass-market product while introducing a premium variant bundled with Flipkart Black to better serve high-spending customers.

Alternatives: SBI Cashback, HDFC Swiggy, SBI PhonePe Select Black, HDFC TataNeu Infinity.

Axis Flipkart Credit Card

Does the Flipkart Axis Bank credit card offer complimentary airport lounge access?

No, this benefit is not available anymore.

What are the other partner merchants where Axis Bank Flipkart Credit Card earns a cashback of 4%?

You get a 4% cashback on spending on partner merchants, including Swiggy, Uber, PVR, and Cult.fit.